Real estate investment can be a lucrative option for those looking to grow their wealth and achieve a high return on investment (ROI). Whether you’re a seasoned investor or just starting out, understanding the basics of real estate investment can help you make informed decisions and maximize your profits.

Understanding the Market and Trends:

Before investing in housing and real estate, it’s important to have a good understanding of the market and current trends. This includes researching current real estate prices, rental demand, and the overall state of the economy. Additionally, it’s essential to stay up-to-date on changes in the market and be able to anticipate future trends.

Location Matters: Choosing the Right Area to Invest:

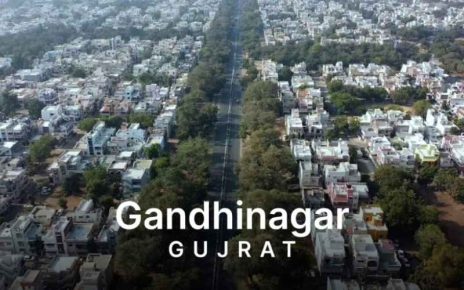

Location is a crucial factor when it comes to real estate investment. Properties located in desirable areas with high rental demand and potential for appreciation will typically provide a higher ROI than those in less desirable locations. Consider factors such as proximity to schools, public transportation, and local amenities when choosing a location to invest in.

Diversifying Your Portfolio with Different Property Types:

Diversifying your real estate portfolio by investing in different property types, such as residential, commercial, or industrial properties, can help reduce risk and increase your overall ROI. Consider exploring different options to see which types of properties are the best fit for your investment goals and risk tolerance.

Assessing the Risks and Potential Rewards:

Investing in real estate is not without risk. It’s important to carefully consider the potential risks and rewards associated with a particular property or investment strategy. This may include factors such as market conditions, property management, and financing options. By taking the time to assess the risks and rewards, you can make informed investment decisions that help maximize your ROI.

Building a Strong Team of Professionals:

Having a strong team of professionals, such as real estate agents, attorneys, and accountants, can provide valuable support and guidance throughout the investment process. These experts can help you navigate the market, find properties, and provide advice on financing and tax benefits.

Taking Advantage of Tax Benefits:

Investing in real estate can offer several tax benefits, including deductions for mortgage interest, depreciation, and property expenses. By understanding the tax implications of real estate investment, you can reduce your tax bill and maximize your ROI.

Staying Current with Real Estate Education:

Continuing education is important for all investors, especially in the rapidly changing real estate market. Staying up-to-date on market trends, investment strategies, and industry best practices can help you make informed decisions and maximize your ROI.

Utilizing Leverage to Maximize Returns:

Leverage can be a powerful tool when investing in real estate. By using leverage, you can increase your buying power and make investments that would otherwise be out of reach. However, it’s important to understand the risks associated with leverage and carefully consider your investment strategy.

Patience and Long-Term Thinking:

Successful real estate investment often requires patience and a long-term perspective. Investing in properties with the goal of holding them for several years can help increase the value of your portfolio and provide a high ROI over time.

What kind of real estate investment has the highest ROI?

The type of real estate investment with the highest ROI can vary based on a number of factors, including market conditions, location, and individual investment goals. However, some popular investment types that are known to provide high returns include rental properties, fix-and-flip projects, and commercial real estate. Rental properties can provide a steady stream of income through rent payments, while fix-and-flip projects involve purchasing a property, renovating it, and selling it for a profit. Commercial real estate, such as office buildings, retail spaces, and industrial properties, can also provide a high ROI due to their potential for strong rental income and appreciation. Ultimately, the type of real estate investment with the highest ROI will depend on the individual investor’s goals, risk tolerance, and market conditions. It is important to carefully consider these factors and seek advice from real estate professionals before making any investment decisions.

Conclusion: Maximizing Your ROI with Real Estate Investment:

Real estate investment can offer a high return on investment if approached with a well-informed and strategic approach. By understanding the market, diversifying your portfolio, building a strong team of professionals, taking advantage of tax benefits, and thinking long-term, you can maximize your ROI and achieve your financial goals. Remember to always do your research, assess the risks and potential rewards, and remain patient and disciplined in your approach. With careful planning and execution, real estate investment can be a powerful tool for building wealth and securing your financial future.